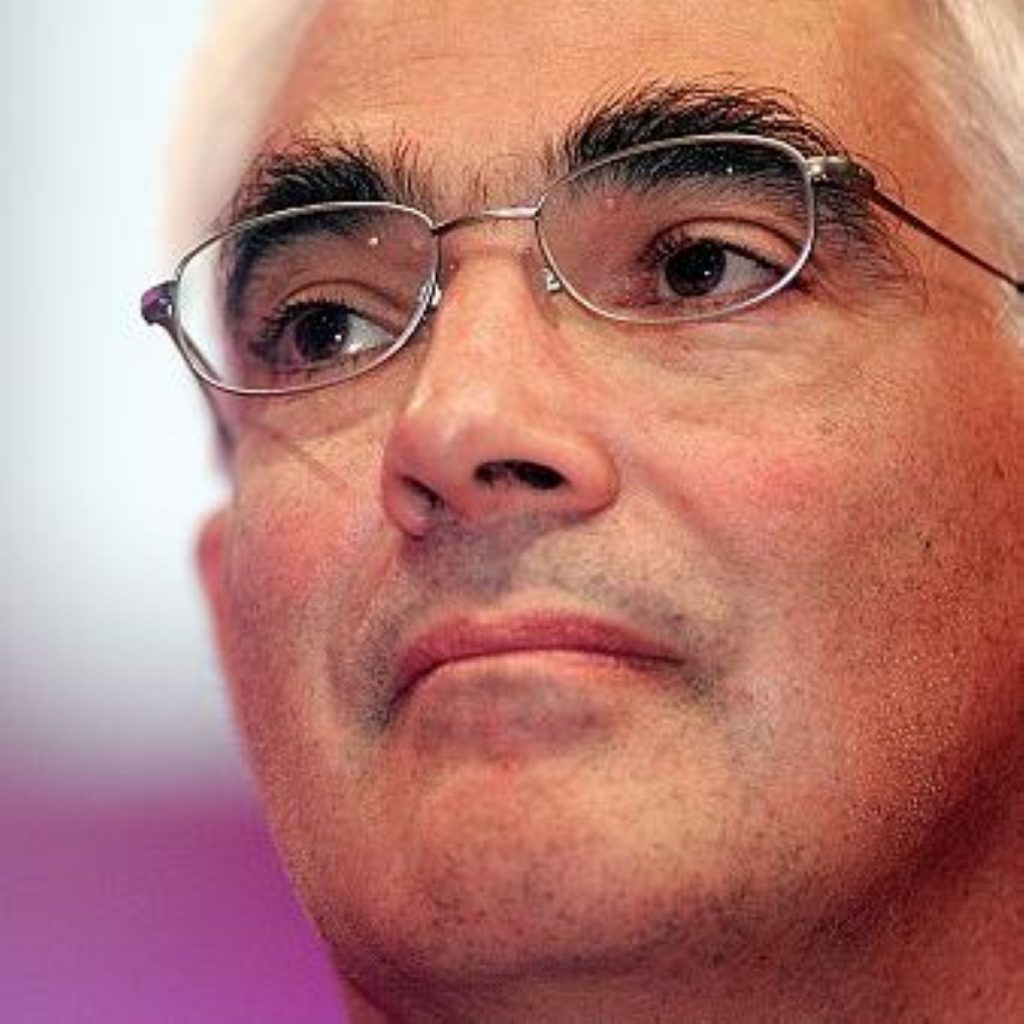

Darling silent on savings

Alistair Darling has resisted pressure to guarantee all savings in the UK despite the financial chaos devastating Europe.

The chancellor remained silent on unlimited guarantees in a Commons statement this afternoon.

However, he did reaffirm the government’s commitment to doing all it can to support UK banks and that the ultimate responsibility rests with him.

“Financial transactions are at the heart of everything we do. They allow people to buy goods, pay for services, buy homes, save for pensions, and invest,” he said.

“So it’s essential that we take action to both support the banking system as a whole – as well as being ready to intervene in particular cases when it’s necessary to do so.”

Mr Darling added; “It’s not a case of doing either one or the other. Both general support and individual intervention are necessary.”

He pledged further resources will be made available to give the financial system sufficient liquidity and the Financial Services Authority (FSA) would monitor the future of saver guarantees in light of international developments.

However, he failed to give any details of solid new measures.

The chancellor spoke to parliament as financial markets across the world struggled further from the banking crisis after the German government stepped in to rescue troubled bank Hypo Real Estate.

German chancellor Angela Merkel had earlier implied that her government would extend protection for savers, but her comments were misread as an unlimited guarantee for deposits.

Shadow chancellor George Osborne questioned whether the government was told about the German decision, but pledged to work with the chancellor.

“Events are moving fast with the broader guarantees issued by first Ireland and Greece, then Germany and Denmark and others,” Mr Osborne told the Commons.

“Will the chancellor confirm that none of these countries informed the British government in advance and does he agree that it is not helpful for European leaders to call for international co-ordination at summits and then hours later act unilaterally?”

Mr Darling said the Irish government’s decision to guarantee savings, since followed by a number of European Union members was a surprise to the rest of the bloc.

The chancellor also hit out at member states acting unilaterally and called on nations to work together.

Last week protection for UK savers was extended to £50,000, which the government hoped would be its upper limit.

The pressure for an extended savings guarantee coincided with the inaugural meeting of the National Economic Council, announced by Gordon Brown last week.

The council, dubbed a ‘war cabinet’ by commentators, will involve an assessment of the current financial situation and analysis of the latest developments in global commodity markets with an eye to their effects on the UK.

-01.png)